Analysis of the implications of the value-added tax on clean cooking in Kenya - James E. Rogers Energy Access Project

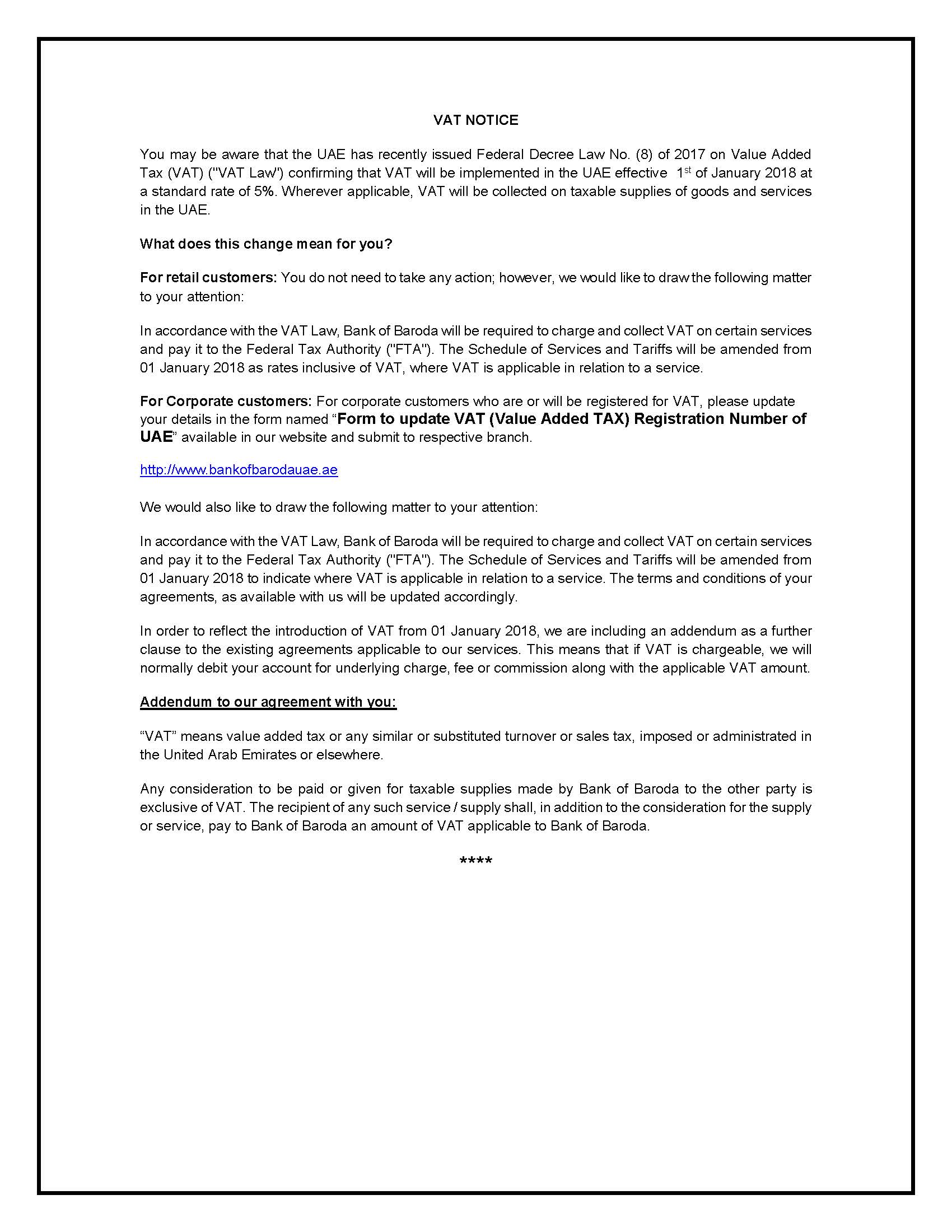

Stanbic Bank Botswana - Dear Valued Customers, Please be advised that the Value Added Tax (VAT) rate will change from 14% to 12% effective 1 August 2022 as announced by the government

التواصل الحكومي on Twitter: "Applying the #VAT in the Sultanate comes as per the unified agreement for VAT in the GCC countries. The VAT will be applied at a rate of 5%

Value Added Tax (VAT) will increase from 14 to 15 per cent with effect from today - Eswatini Daily News

![About the Value Added Tax (VAT) in UKl[Rakuten Global Express] Rakuten's Official International Shipping (Forwarding) Service About the Value Added Tax (VAT) in UKl[Rakuten Global Express] Rakuten's Official International Shipping (Forwarding) Service](https://globalexpress.rakuten.co.jp/help/country/tax/images/GB/en_sp03.svg)

:max_bytes(150000):strip_icc()/Value-Added-Tax-bfc9359a52f74ae9a430d4c2d7ce91e2.jpg)