Tax return Australia: what expenses can I claim if I've returned to the office for work? | Life and style | The Guardian

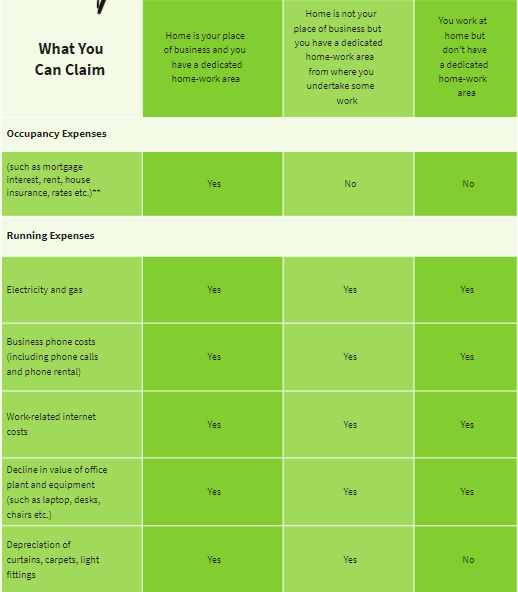

ATO publishes new guidance on claiming deductions while working from home due to COVID-19 - Pitcher Partners

Fintara Tax and Accounting - The ATO has introduced a temporary method to calculate your home office expense for this year's tax return. From 1 March 2020 to 30 June 2020 you